|

|

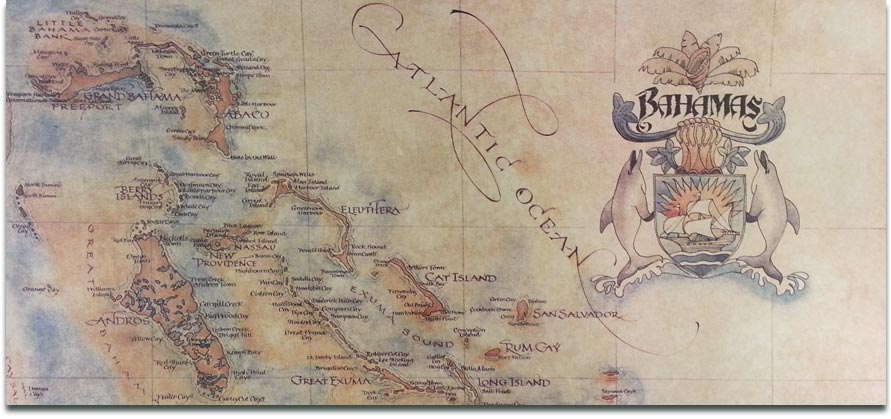

Banking in the Bahamas Why the Bahamas? The Bahamas is one of, if not, the most developed financial centers of the Caribbean, with approximately 400 banks registered in the country. Financial services produces some 15 percent of GDP and is the second-largest industry after tourism. The government seeks to attract foreign banks, and the financial sector is extremely open to foreigners. The government is under extreme pressure from the Organisation for Economic Co-Operation and Development (OECD) and others to tighten regulation of the offshore financial sector.

Growing from a tiny off shore tax haven comprised of a few branches of foreign banks in the mid-sixties to world banking powerhouse. The country's legislation and regulatory structure, comparatively highly-skilled workforce, and its stable government have attracted the some of the most prestigious financial institutions from around the globe.

Air transportation, modern infrastructure, including a telecommunications system, support most kinds of business operations.

The asset base of the Bahamas' banking center is in excess of $200 billion, positioning it among the top ten countries in the world, behind the USA, the UK, Japan, Switzerland and others, with Capital-asset ratios average 11%.

Private banking, portfolio management, and mutual fund administration have gained in importance in recent years, reinforcing the international community's recognition of the Bahamas as a safe repository of the financial assets of both individuals and corporations.

Over 400 banks from thirty-six different countries, including the United Kingdom, Switzerland, France, the United States, Canada, and Japan, are currently licensed to conduct business within or from the Bahamas. Many are branches or subsidiaries.

Licensees include a very active offshore banking community, with almost one hundred Euro Currency branches of international banks and trusts, as well as 168 Bahamian incorporated institutions. Over 60% of all the banks licensed within the Bahamas, offer trust services in addition to their regular banking operations.

The banking community of the Bahamas is supervised by the Central Bank of the Bahamas, which attempts to maintain a regulatory environment conducive to investment opportunities, while ensuring the high standards of conduct, as developed by the Basil Committee on Banking Supervision.

The self-regulatory code of conduct of the Association of International Banks and Trust Companies (AIBT) also deters the use of financial operations for criminal activities and upholds the principles of bank secrecy.

The government remains involved in the financial sector through ownership of the Bahamas Mortgage Corporation and the Bahamas Development Bank, which primarily provides financing for commercial, industrial, and agricultural development projects.

In an effort to secure its removal from the Organisation for Economic Co-operation and Development's (OECD) list of jurisdictions with a non-cooperative record on money laundering, the Bahamas passed a package of legislation to tighten controls on such activity. The new legislation imposes extra regulatory costs on the financial sector but does not constrain financial services.

The U.S. Department of Commerce reports that 270 banks and trust companies were licensed as of September 2004, down from 415 in 1999. The contraction is a result of stricter regulation and supervision, intended to comply with international Financial Action Task Force (FATF) and OECD standards, that has led the government to suspend licenses for a large number of banks that could not show proof of an actual physical presence.

The FATF, an intergovernmental body designed to combat money laundering and made up of 31 countries and territories, the European Commission and the Gulf Cooperation Council, removed the Bahamas from its list of jurisdictions with a non-cooperative record on money laundering in June 2001.

|